ScoutBook | PayPal/Venmo Update for BSA Units

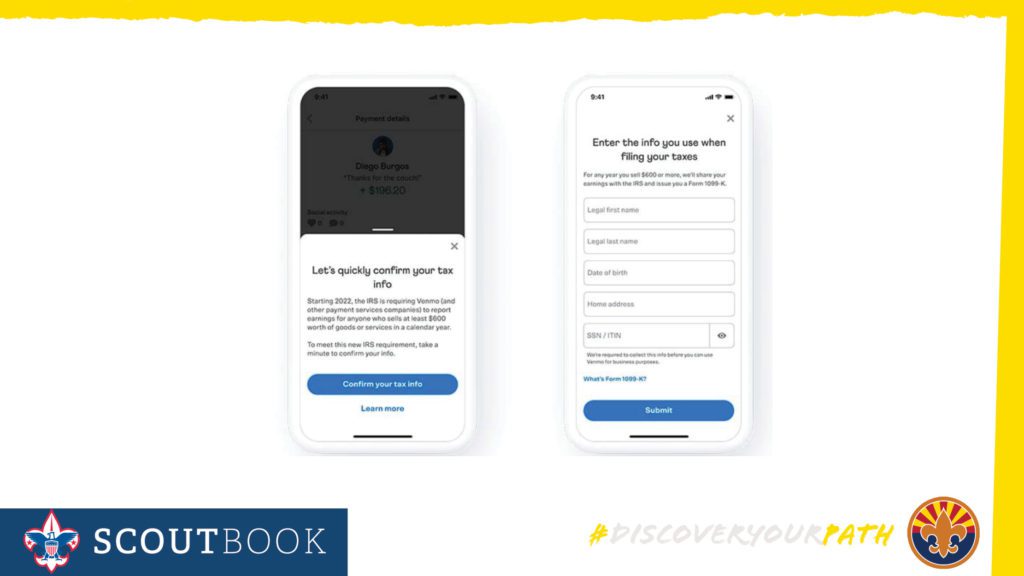

Beginning January 1, 2022, the Internal Revenue Service (IRS) introduced new reporting requirements for payments received for goods and services, which will lower the reporting threshold to $600 for the 2022 tax season, from 2021’s threshold of $20,000 and 200 transactions. These reporting requirements are only for payments received for a good or service, and do not apply to payments from friends or family. Under the new requirements, payment service companies, including PayPal and Venmo, will provide customers with a 1099-K form if they receive $600 or more in a calendar year for payments received for goods or services. Users may receive notifications to complete tax information like the example below.

BSA PayPal Scoutbook instructions (available at https://help.scoutbook.scouting.org/knowledgebase/paypal-payment-utility-sb/) direct units to follow the same account opening procedures as for bank accounts. Charter Organization Units and Council Registered Units utilizing PayPal or Venmo should ensure they are using appropriate EINs and following all policies and procedures. Parents of/Groups of Citizens Units should consult their own tax advisors. If you have any questions, please reach out to your tax advisor or local council.